Salary plus overtime calculator

The new base must be calculated using the total regular pay. This employees total pay due including the overtime premium for the workweek can be calculated as follows.

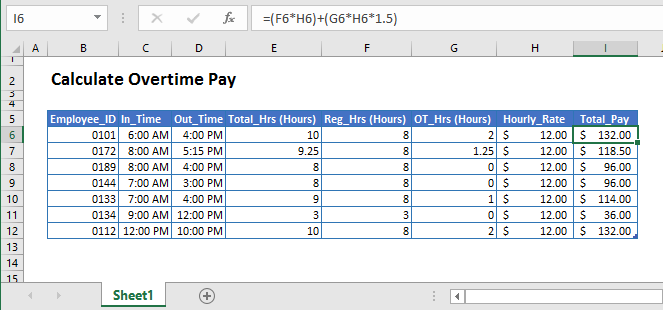

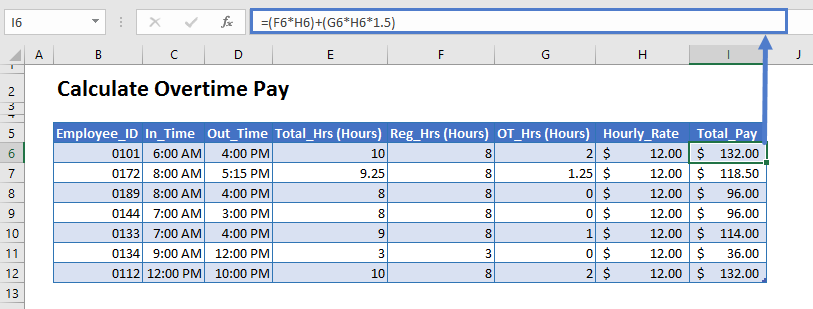

Calculate Overtime In Excel Google Sheets Automate Excel

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

. Unless exempt employees covered by the Act must receive overtime pay for hours. 35 hours x 12 10 hours x 15 570 base pay 570 45 total. 87545 hours 1944-per.

Plus this overtime and holiday pay rate. California overtime law requires employers to pay nonexempt employees who are 18 years of age or older for overtime hours worked. For employees who are between 16-17 years of age.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. TP RP. You can claim overtime if you are.

2 x 225 45. See where that hard-earned money. 15hour 45 hours 675 plus 200 commission 875 base pay for the week.

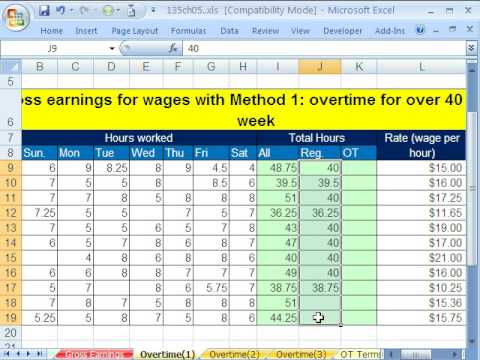

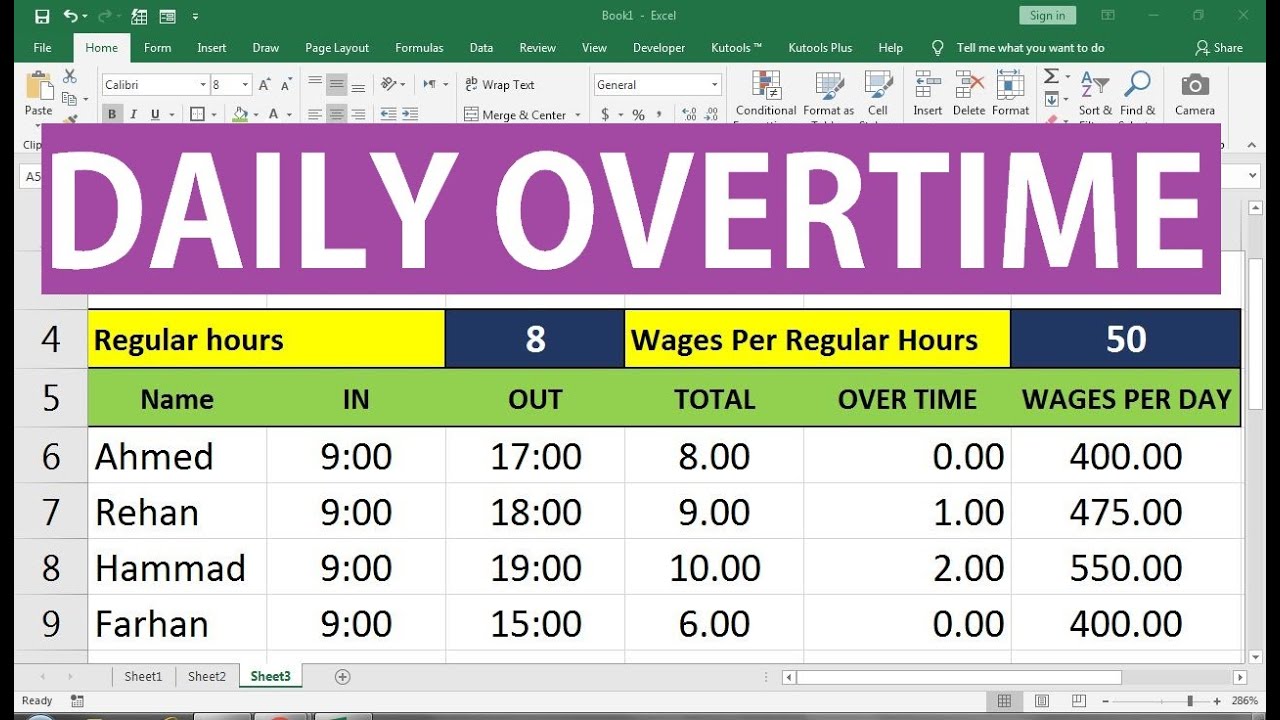

The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week. The overtime calculator uses the following formulae. For example if an employee works 45 hours one weekinstead of the standard 40you may owe them 5 hours of overtime pay.

The federal overtime provisions are contained in the Fair Labor Standards Act FLSA. Calculate the complete payment for the. OP Overtime pay n number of overtime hours per month Now If you want to calculate the total salary of the month then you need to add overtime pay to your regular salary.

This overtime calculator figures your total overtime paycheck and the OT rate together with the regular pay by taking account of the number of hours worked. If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime. Calculate the overtime pay which is the number of overtime hours x the overtime hourly rate.

The Fair Labor Standards Act FLSA Overtime Calculator Advisor provides employers and employees with the information they need to understand Federal overtime requirements. Hourly Wage Tax Calculator 202223. This overtime calculator figures your total overtime paycheck and the OT rate together with the regular pay by taking account of the number of hours worked.

48 x 15 720.

How To Quickly Calculate The Overtime And Payment In Excel

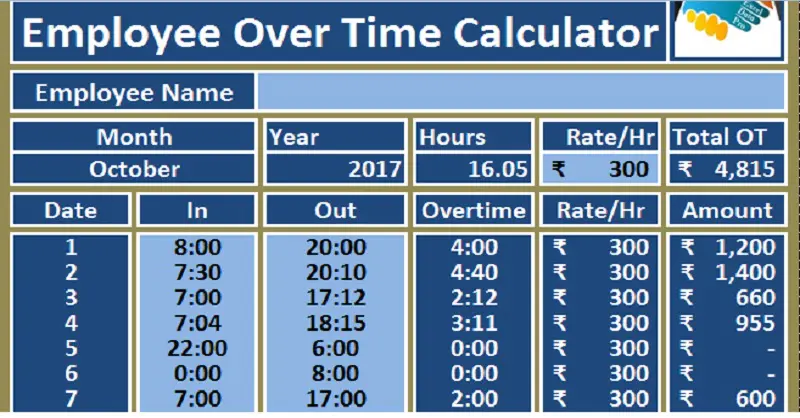

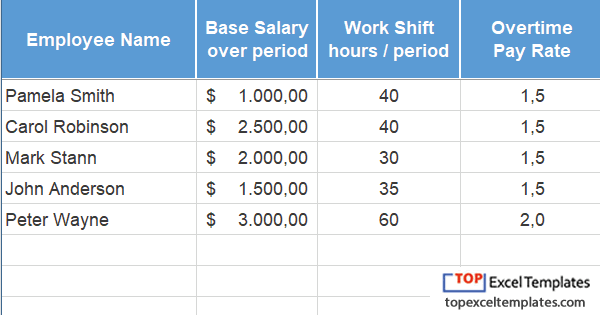

Download Employee Overtime Calculator Excel Template Exceldatapro

Overtime Calculator To Calculate Time And A Half Rate And More

Excel Formula Basic Overtime Calculation Formula

Excel Formula Timesheet Overtime Calculation Formula Exceljet

Overtime Calculator

Calculate Overtime In Excel Google Sheets Automate Excel

Calculate Overtime In Excel Google Sheets Automate Excel

Simple Overtime Calculator Excel Free Template Spreadsheet Example

Excel Busn Math 38 Gross Pay And Overtime 5 Examples Youtube

Ready To Use Overtime Calculator Template With Payslip Msofficegeek

Overtime Calculator Workest

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

Overtime Pay Calculators

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Overtime Pay Calculators

Overtime Calculation Formula In Excel Youtube